Business Insurance in and around Princeton

Searching for coverage for your business? Look no further than State Farm agent Brady Paxman!

Insure your business, intentionally

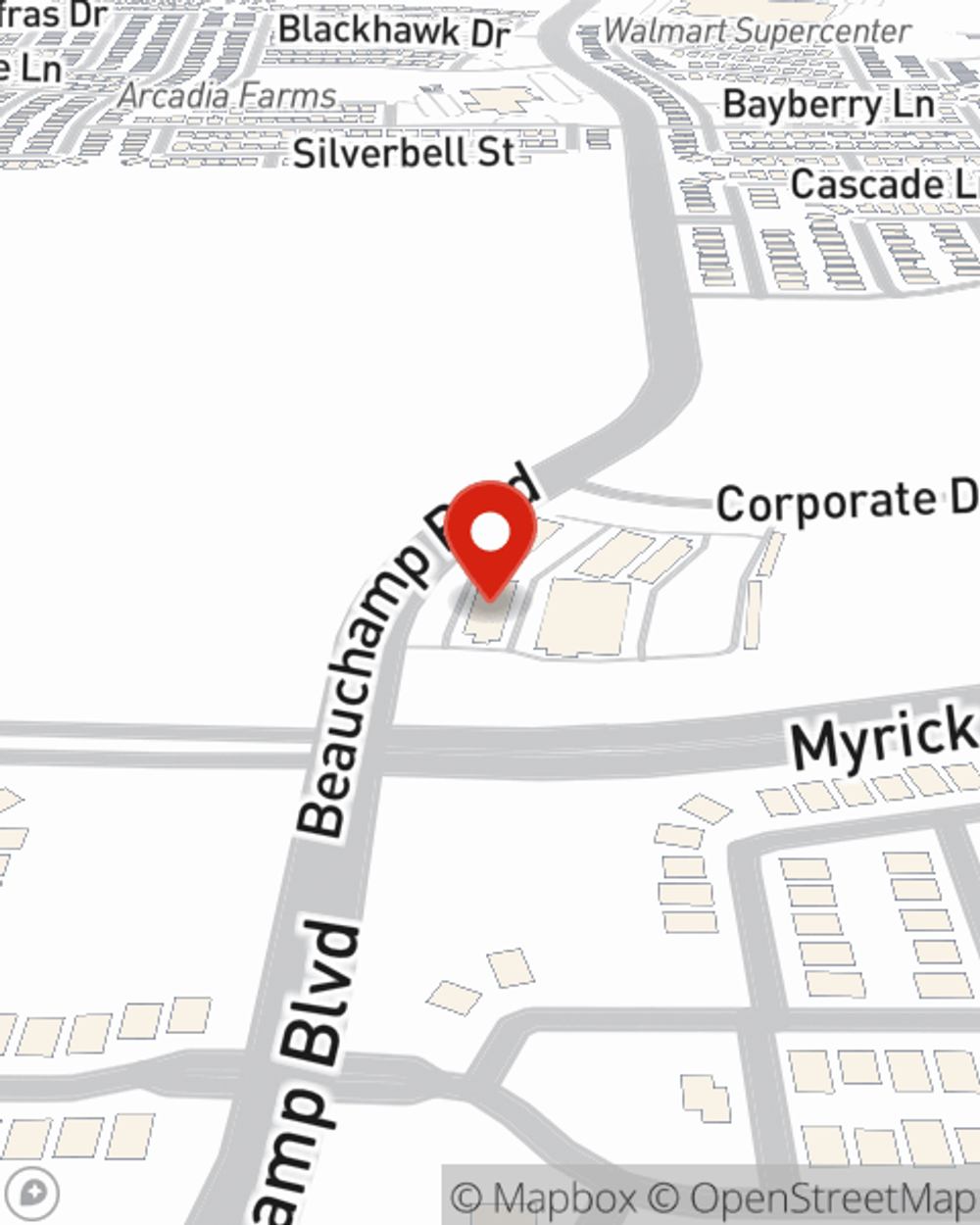

- Princeton, TX

- Melissa, TX

- Mckinney, TX

- Farmersville, TX

- Allen, TX

- Plano, TX

- Frisco, TX

- Oklahoma

- Arkansas

- Louisiana

- Anna, TX

Help Protect Your Business With State Farm.

When experiencing the highs and lows of small business ownership, let State Farm take one thing off your plate and help provide terrific insurance for your business. Your policy can include options such as extra liability coverage, errors and omissions liability, and a surety or fidelity bond.

Searching for coverage for your business? Look no further than State Farm agent Brady Paxman!

Insure your business, intentionally

Keep Your Business Secure

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance policies by small business owners like you. You can work with State Farm agent Brady Paxman for a policy that protects your business. Your coverage can include everything from errors and omissions liability or worker's compensation for your employees to key employee insurance or commercial auto insurance.

Ready to learn more about the business insurance options that may be right for you? Get in touch with agent Brady Paxman's office to get started!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Brady Paxman

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.